Let’s be honest—the creator economy is a financial rollercoaster. One month you’re riding high on a viral video’s ad revenue, the next you’re staring at a confusing tax form wondering if that gifted product counts as income. Spoiler: it often does.

Managing money here isn’t about spreadsheets for spreadsheets’ sake. It’s about building a sustainable business from your passion. And that starts with understanding the three main revenue streams: platforms, sponsorships, and digital products. Each has its own accounting quirks, its own rhythm. Let’s break them down.

The Platform Puzzle: Tracking Fragmented Income

Platform payouts—from YouTube AdSense, TikTok’s Creativity Program, Spotify for Podcasters, or Subscriber revenue—are the bedrock for many. But here’s the deal: this income is notoriously fragmented and passive. It flows in from multiple sources, often with different payout thresholds and schedules.

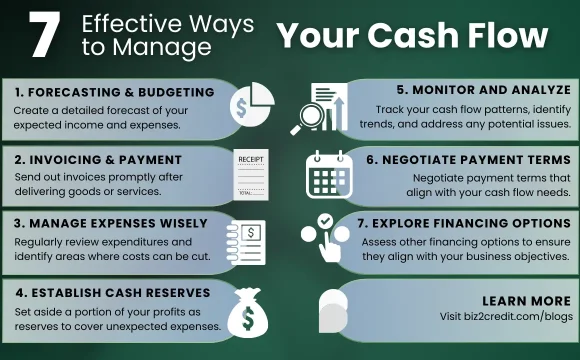

The biggest challenge? It’s all pre-tax. No one is withholding anything for the IRS or your local tax authority. That money feels like pure profit until, well, tax season hits. A good practice—honestly, a non-negotiable one—is to immediately set aside 25-30% of every platform payout into a separate savings account. Think of it as paying your future self to avoid a massive headache.

You also need a system to track it all. A simple spreadsheet can work at first:

| Platform | Month | Gross Revenue | Fees/Deductions | Net Received |

|---|---|---|---|---|

| YouTube | March 2024 | $1,200 | $0 | $1,200 |

| Patreon | March 2024 | $850 | $85 (platform fee) | $765 |

| TikTok | March 2024 | $310 | $0 | $310 |

This isn’t just for taxes. Seeing which platforms actually drive your net income is crucial for deciding where to focus your energy. That Patreon fee, for instance, is a real business expense.

Sponsorships & Brand Deals: The Art of the Invoice

Sponsorship money feels different. It’s active, project-based, and often larger. But with bigger checks come bigger accounting responsibilities. This is where you transition from “creator” to “freelancer” in the eyes of the law and the brand.

First, always, always have a contract. It protects both parties and clarifies the financial terms: the total fee, payment schedule (e.g., 50% upfront, 50% on delivery), and what happens if deliverables change.

Second, master the invoice. Your invoice is your professional handshake. It should include:

- Your business name (even if it’s just your personal name).

- An invoice number and date.

- A clear description of the work.

- The agreed-upon amount and payment terms (Net 30 is standard).

- How to pay you (PayPal, bank transfer, etc.).

And here’s a key point: that “free” product you got for a review? The IRS typically considers its fair market value as taxable income. You need to track those gifts, too. Log them in your spreadsheet with an estimated value. It’s a pain, but it’s part of the game.

Managing 1099s and Keeping Records Straight

If a brand pays you more than $600 in a year, you’ll likely get a 1099-NEC form. The catch? They send one to you and the IRS. Your reported income needs to match theirs. Discrepancies raise red flags. So, keep your own records meticulously—don’t just wait for the forms to arrive in January.

Digital Products & Direct Sales: Your Own Revenue Engine

This is where things get exciting—and a bit more complex. Selling your own presets, e-books, courses, or merchandise means you’re running a direct-to-consumer shop. You control the pricing, the customer relationship, and… the sales tax nexus. Yeah, that’s the tricky bit.

When you sell a digital product, you’re generally collecting revenue through a third-party processor like Stripe, PayPal, or Gumroad. These platforms usually handle the sales tax calculation and remittance for you—a huge relief. But you are still responsible for reporting that income as business revenue.

For physical goods (merch), the logistics multiply. You need to account for:

- Cost of Goods Sold (COGS): What it cost to produce the t-shirt, mug, or art print.

- Shipping & Fulfillment: These are direct expenses that eat into your profit margin.

- Sales Tax: Depending on where you and your customers are located, you may have to collect and remit sales tax to multiple states.

Honestly, using a dedicated e-commerce platform like Shopify or even a simplified service like Printful (which handles fulfillment and tax) can automate 90% of this accounting burden. It’s worth the fee.

Pulling It All Together: Systems Over Stress

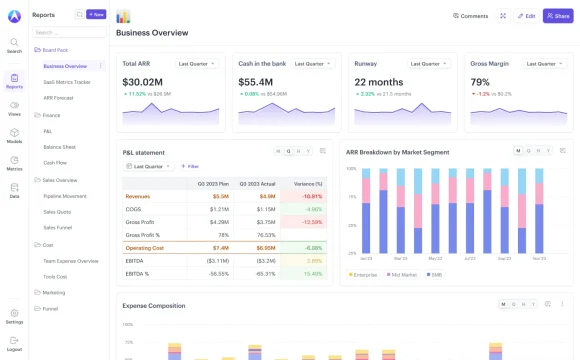

So you’ve got money trickling in from five platforms, a sporadic brand deal, and a steady drip of course sales. How do you not drown in the data? You build a simple, repeatable system.

1. Dedicate a Business Bank Account: This is step zero. Route all creator income and pay all business expenses from this account. It makes tracking everything infinitely easier.

2. Pick a Tracking Tool: This could be a well-organized Google Sheet, a tool like QuickBooks Self-Employed, or even a personal finance app with strong tagging features. The goal is to have one place where you log income (categorized by source) and expenses.

3. Schedule Weekly “Money Minutes”: Every Friday, spend 15 minutes updating your log. Invoiced a brand? Log it. Got a payout from Etsy? Log it. Bought a new microphone? Log it as an expense. This tiny habit prevents quarterly panic.

4. Understand Your Deductions: This is the perk. That portion of your rent for your home studio? Deductible. Your editing software subscriptions, camera gear (often depreciated over time), internet bill, even courses you take to improve your skills—these are legitimate business expenses that reduce your taxable income.

When to Call in a Professional

Look, there’s a point where DIY accounting becomes a false economy. If you’re making consistent money across multiple streams, or if the thought of “estimated quarterly taxes” gives you cold sweats, hire a CPA or accountant who understands the creator economy. They’ll save you money, ensure compliance, and give you peace of mind. That peace of mind, frankly, lets you get back to creating.

In the end, accounting for your creator business isn’t about restriction. It’s the opposite. It’s about clarity. It’s the map that shows you where your revenue streams are flowing and where they’re drying up. It transforms that chaotic, creative hustle into a real, resilient enterprise. You built the audience. Now, with a little number-crunching, you can build the foundation that lets it last.