Let’s be honest. The subscription model is a beautiful thing for a business. Predictable cash flow, loyal customers, that lovely MRR number climbing each month… it feels more like a membership club than a traditional sale. But here’s the deal: that financial beauty can turn into an accounting beast if you’re not careful.

Why? Because the money hitting your bank account isn’t always yours to claim as revenue. That’s the core, mind-bending shift from one-time sales to subscriptions. You’re being paid for a promise of future service. And accounting standards (hello, ASC 606 and IFRS 15) have very specific rules about how to recognize that revenue over time.

The Core Challenge: Revenue Recognition vs. Cash Collection

Think of it like a magazine subscription. A customer pays you $120 for a yearly subscription today. Your bank account is happier, sure. But you haven’t delivered all 12 magazines yet. From an accounting standpoint, you can’t just book the whole $120 as revenue now. You have to recognize it gradually, as you fulfill your obligation—$10 each month as you send out the issue.

That gap between cash-in-hand and revenue-earned? That’s where the magic—and the complexity—of accounting for subscription-based businesses lives. You need to track deferred revenue (the cash you owe in future service) and recognized revenue meticulously.

Key Terms You Can’t Ignore

Before we dive deeper, let’s demystify the jargon. You’ll hear these constantly:

- Deferred Revenue (or Unearned Revenue): This is a liability on your balance sheet. It’s the cash you’ve collected but haven’t yet “earned” by delivering the service.

- Revenue Recognition: The process of moving money from deferred revenue to earned revenue on your income statement, following the rules of the revenue standard.

- Performance Obligation: Fancy term for the promise you make to a customer. A software subscription might be one obligation; a subscription box of physical goods is another.

- Contract Liability vs. Asset: If you get paid upfront, you have a contract liability (deferred revenue). If you deliver first and bill later, you have a contract asset (like unbilled receivables).

Mapping the Subscription Accounting Workflow

So, what does this actually look like in practice? Here’s a simplified view of the cycle.

| Step | Action | Accounting Impact |

| 1. Sign-Up & Payment | Customer pays $120 annually upfront. | Cash increases by $120. Deferred Revenue increases by $120 (a liability). |

| 2. Month 1 Service | You provide access for the first month. | Deferred Revenue decreases by $10. Earned Revenue increases by $10 on the P&L. |

| 3. Months 2-12 | Repeat monthly service. | Each month, recognize $10, reducing the liability until it’s zero. |

Seems straightforward for a simple plan. But what about upgrades, downgrades, prorations, and—the big one—churn? That’s when the spreadsheet hell can begin if you’re manual.

The Tricky Parts: Where Subscription Accounting Gets Messy

Honestly, the basics are one thing. The real-world complications are another. Here are the major pain points for founders and accountants.

1. Variable Considerations & Discounts

Offering a free trial? A first-month discount? A yearly plan at a 20% savings? These are “variable considerations.” You have to estimate their value and allocate them across the subscription term. It’s not just about the cash price; it’s about the expected revenue from the contract.

2. Contract Modifications (Changes & Churn)

A customer upgrades mid-cycle. Do you recognize the extra money immediately? Nope. You must re-allocate the total contract value and adjust the recognition schedule going forward. Same for a downgrade or cancellation. This requires constant recalculation—a massive burden without automated recurring revenue management software.

3. Capitalization of Customer Acquisition Costs (CAC)

This one’s huge for SaaS and subscription boxes. The sales commissions and marketing costs to land that subscriber? Under ASC 606, you might need to capitalize and amortize these costs over the life of the customer contract, not just expense them all upfront. This smooths out your expenses and matches them to the revenue they generate. It’s complex but gives a truer picture of unit economics.

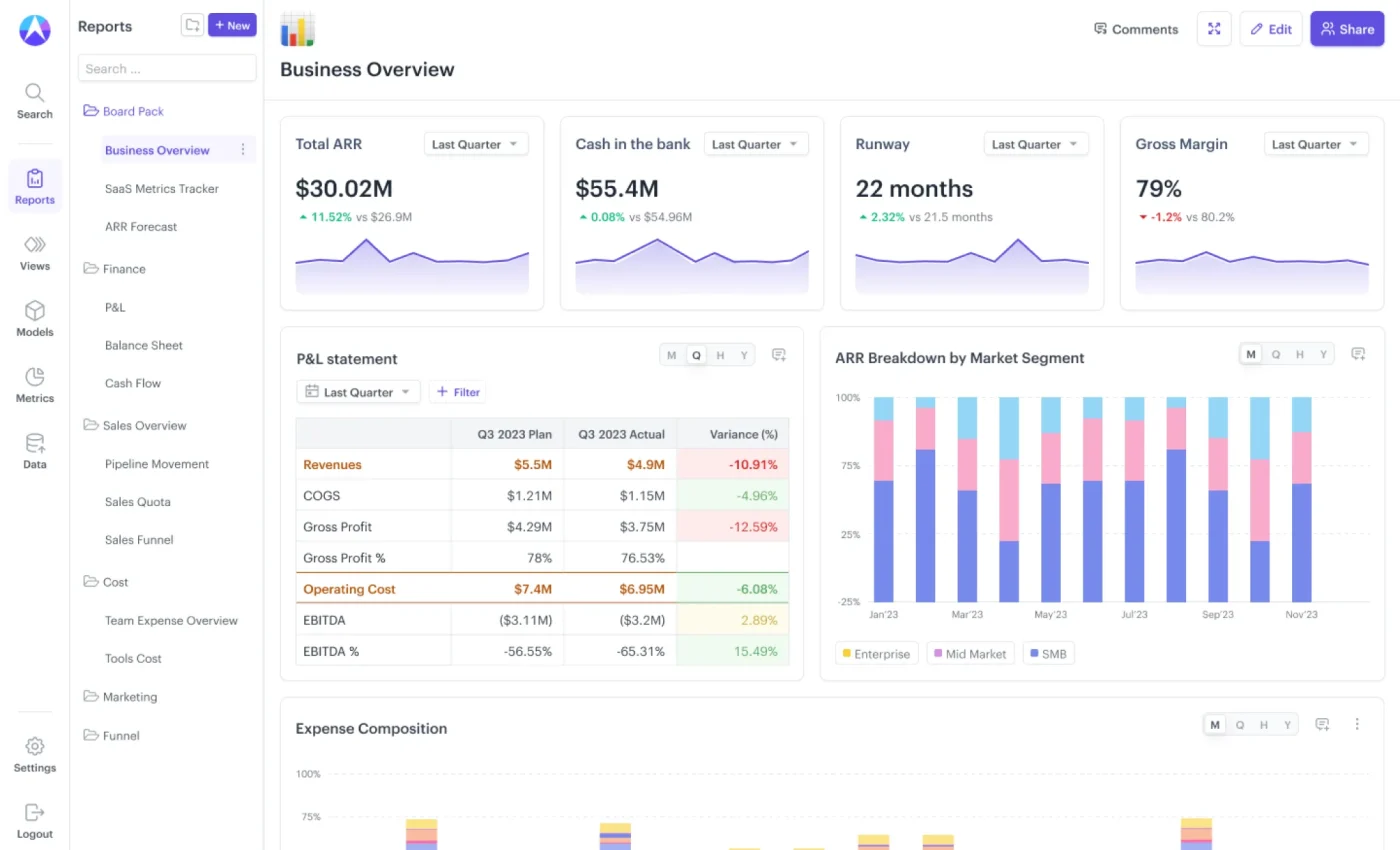

Essential Metrics You’ll Need to Track

Your accounting system isn’t just for compliance. It should feed the key metrics that drive your business decisions.

- Monthly Recurring Revenue (MRR) / Annual Recurring Revenue (ARR): The lifeblood. This should be based on recognized revenue, not just cash, for accuracy.

- Churn Rate: Revenue churn and customer churn. Is your deferred revenue liability shrinking for the wrong reasons?

- Customer Lifetime Value (LTV): Relies heavily on accurate revenue and cost amortization data.

- Deferred Revenue Balance: A key balance sheet health indicator. A growing balance can mean strong future revenue, but also a large future service obligation.

Tools & Tips to Keep Your Sanity

You can’t do this on a basic spreadsheet past a handful of customers. It’s a recipe for errors and all-nighters before an audit. Here’s what to consider:

- Use a Dedicated Subscription Billing Platform: Tools like Stripe Billing, Chargebee, or Recurly handle proration, invoicing, and—critically—can sync detailed data to your accounting software.

- Integrate with a Robust Accounting System: QuickBooks Online, Xero, or NetSuite. Look for native integrations or use a connector like Zapier to automate journal entries for recognized revenue.

- Consider the “Right” Way from Day One: Even if you’re small, adopting ASC 606/IFRS 15 principles early makes scaling infinitely easier. Talk to an accountant who gets subscription models.

- Automate, Then Verify: Let software handle the monthly recurring entries. But you know, schedule a quarterly review to reconcile your deferred revenue accounts. Trust, but verify.

The Bottom Line: Clarity Over Convenience

Sure, taking the cash and booking it as revenue is simpler in the short term. But it paints a distorted picture. It inflates your success now at the expense of tomorrow’s numbers. Proper accounting for the subscription-based business model forces discipline. It ties your financial reporting directly to the value you’re actually delivering.

In the end, it’s about building a business that’s sustainable, understandable to investors, and built on a foundation of real numbers—not just hopeful cash flow. That clarity, as tedious as the path to get there might seem, is what separates a hobby from a viable, scalable enterprise. And honestly, that’s the whole point, isn’t it?