Let’s be honest. For most nonprofit leaders, “financial management” conjures images of spreadsheets, budget meetings, and grant reports. Necessary, sure. But inspiring? Not so much.

What if we flipped the script? What if your finances weren’t just about tracking dollars, but about amplifying impact? That’s the real shift happening right now. The most forward-thinking organizations are weaving impact measurement directly into their financial DNA. It’s not just accounting; it’s storytelling with numbers. And it’s changing everything.

Why Old-School Budgeting Isn’t Enough Anymore

Traditionally, nonprofit finance was a rear-view mirror activity. You looked at last year’s expenses, made some adjustments, and hoped for the best. Donors wanted to see low overhead. The focus was on cost, not value.

That model is, well, breaking down. Today’s funders—from foundations to individual donors—are asking harder questions. They don’t just want to know what you spent; they demand to know what difference it made. Your financial story is incomplete without your impact story. And that’s where the right tools come in.

The Tangible Pain Points

Without linking money to mission, you face real struggles. You might be allocating funds to programs that are comfortable, but not necessarily the most effective. You’re making budget cuts in the dark. And when a major donor asks for outcomes data, your team scrambles, pulling data from three different systems. It’s exhausting and inefficient.

Impact Measurement: Your Financial Compass

Think of impact measurement tools not as another reporting burden, but as a financial compass. They give you directional clarity. By tracking outcomes alongside expenses, you start to see the cost-per-impact. How much does it really cost to provide one student with a year of tutoring? To plant one acre of restored wetland? To connect one person to stable housing?

That single metric—cost-per-impact—is a game-changer. It transforms abstract mission statements into concrete, financial decision-making data.

Practical Integration: Where the Rubber Meets the Road

Okay, so how does this actually work in practice? It’s about aligning your chart of accounts with your theory of change. Here’s a simplified view of what that integration can look like:

| Financial Category (Old Way) | Integrated View (New Way) |

| Program Expense: Tutoring Salaries | Cost associated with Outcome: “Improved literacy scores for 50 students.” |

| Administrative: Software Subscription | Cost of Impact Tool tracking client progress & well-being metrics. |

| Fundraising: Gala Event | Investment that secured funds for Program X, which yields Y outcome. |

See the difference? The right column tells a powerful, unified story. It directly connects a line item to a mission result.

Choosing and Using the Right Tools

You don’t need the most expensive platform on day one. The key is to start simple and be consistent. Look for tools that can talk to each other—or better yet, platforms that combine financial and impact data. Many organizations use a blend of:

- Dedicated Impact Software: Tools like Social Solutions’ ETO, Salesforce Nonprofit Cloud, or Sopact. These let you define indicators, collect data, and generate reports.

- Enhanced Accounting Systems: Modern nonprofit accounting software (like QuickBooks Nonprofit or Sage Intacct) that allows for custom tagging and reporting by program or outcome.

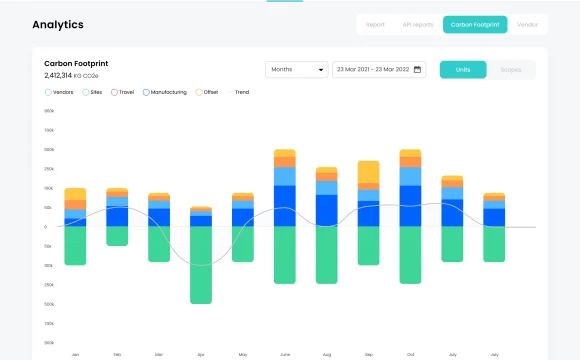

- Data Visualization Dashboards: Using Power BI or Tableau to create live dashboards that show financial and impact metrics side-by-side. This is gold for board meetings.

Honestly, the tool matters less than the process you build around it. Start with one program. Define 2-3 key outcome metrics. Track the costs tied directly to achieving those metrics. Then, build from there.

The Real-World Benefits: Beyond Just Reporting

When you commit to this integrated approach, the benefits ripple out in surprising ways.

- Smarter Budgeting: You can confidently shift funds toward high-impact activities. If mentoring shows a lower cost-per-successful-job-placement than a generic workshop, you have the data to reallocate.

- Transformative Storytelling: Instead of asking for money to “support our work,” you can say, “Your $100 provides ten meals AND connects a family to career counseling, which we know leads to long-term stability 80% of the time.” That’s compelling.

- Staff Motivation & Clarity: Your team sees how their work directly translates to results. It connects the daily grind to the grand vision.

- Building Trust with Stakeholders: You demonstrate radical transparency and a commitment to true stewardship. You’re not just spending donations; you’re investing them for maximum social return.

A Few Cautions on the Journey

This isn’t a magic wand. It’s a cultural shift. Avoid the pitfall of measuring everything that moves—you’ll drown in data. Focus on what truly indicates success for your mission. And remember, qualitative stories (the lived experience behind the numbers) are just as crucial as the quantitative data. The tools should capture both.

Also, let’s not pretend it’s effortless. There’s a learning curve. It requires training and maybe even a shift in staff roles. But the payoff? It’s monumental.

Wrapping Up: From Ledgers to Legacy

In the end, financial management powered by impact measurement is about building a legacy of effectiveness. It moves you from a mindset of scarcity—stretching every penny—to one of strategic abundance: maximizing every dollar for the change you want to see.

You stop being a nonprofit that simply spends money on good things. You become a social impact organization that can prove its value. And in a world clamoring for authenticity and results, that is your most powerful asset. The numbers on your impact dashboard? They’re not just metrics. They’re the echoes of your mission, reflected back in data—and that’s a story worth telling.