Let’s be honest. When you think of accountants, you probably picture spreadsheets, tax forms, and maybe a green visor. Not exactly the frontline warriors in the fight against climate change. But here’s the deal: the green transition is, at its core, a financial one. And that means the language of business—accounting—is becoming the language of sustainability. It’s the critical bridge between environmental impact and the cold, hard numbers on a balance sheet.

More Than Just Counting Carbon: A New Ledger

Traditionally, accounting has been a backward-looking practice. It tallied what already happened. Climate risk flips that script. Now, accountants must quantify what might happen—the potential financial hits from floods, droughts, regulatory shifts, or stranded assets. It’s like asking a historian to write a detailed, financially-backed weather forecast. The tools are evolving, but the goal is clear: to make the invisible, visible.

This isn’t just about corporate social responsibility anymore. It’s about material risk. Investors, lenders, and regulators are demanding to know how exposed a company is. And that demand is where accounting steps in, transforming vague “climate concerns” into concrete figures that can be analyzed, compared, and managed.

Where the Rubber Meets the Road: Key Accounting Functions

So, what does this actually look like in practice? Well, it’s messy, but fascinating. Accountants are now deeply involved in:

- Valuation & Impairment Testing: Re-evaluating the value of assets (like oil reserves or coastal property) under different climate scenarios. Will that factory be underwater in 2050? The answer changes its book value today.

- Liability Recognition: Estimating and reporting future costs for carbon taxes, emission penalties, or environmental clean-ups. This is a huge, and often understated, liability sitting on many balance sheets.

- Disclosure & Reporting: Implementing frameworks like the IFRS S2 or the SEC’s climate rules. It’s not just what you report, but how you assure the data is accurate and consistent—a classic accounting strength.

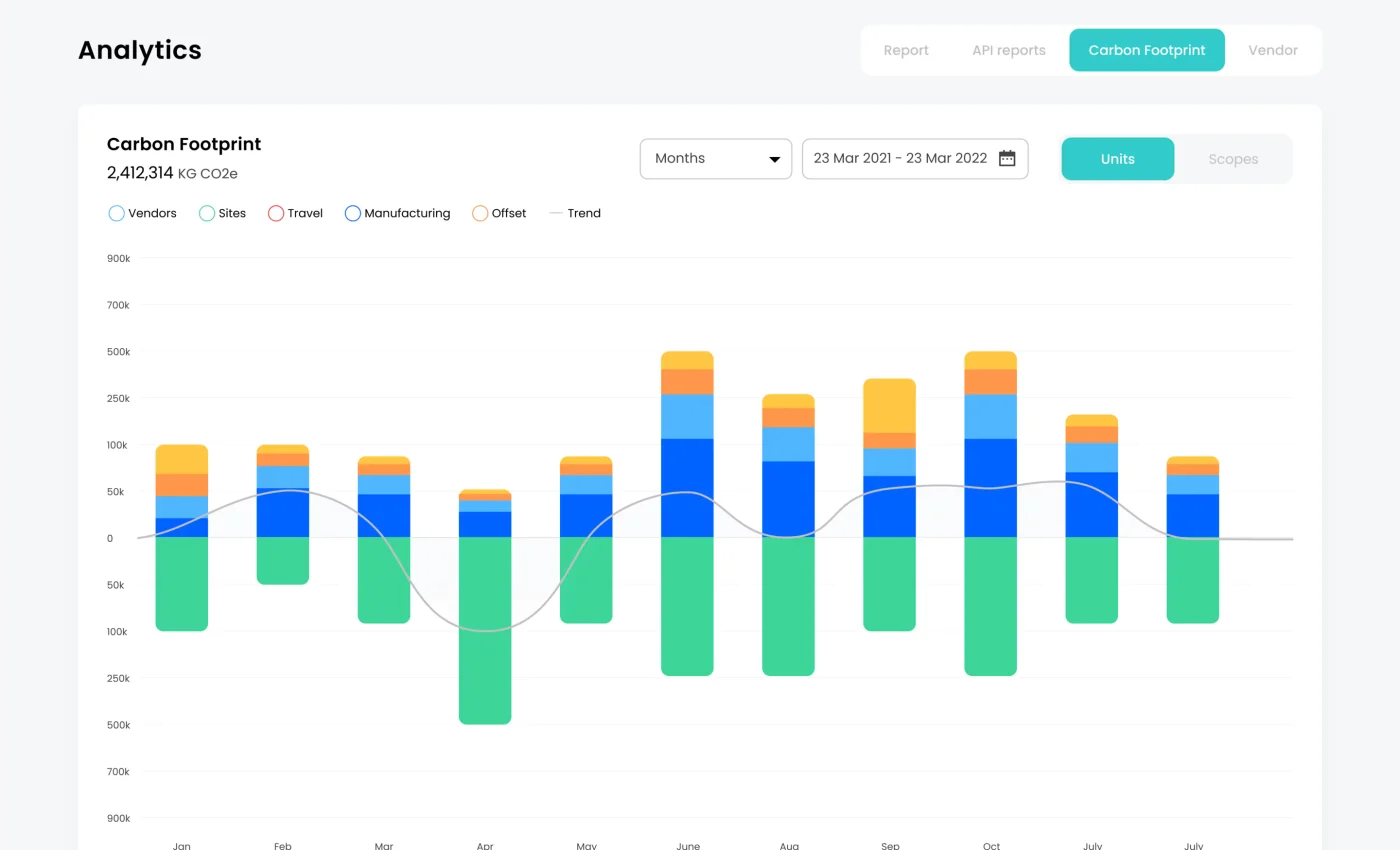

- Internal Carbon Pricing: Creating a shadow price for carbon emissions used internally to guide investment decisions. It makes the environmental cost a direct line item in project evaluations.

The Carbon Credit Marketplace: Accounting’s Wild West

If climate risk assessment is the defensive play, then carbon credit trading is the offensive strategy. And honestly, this market feels a bit like the early days of the internet—full of potential, but rife with complexity and, let’s say, creative interpretations. This is where accountants are absolutely essential to build trust.

Think of a carbon credit as a permission slip. It represents one tonne of carbon dioxide reduced or removed from the atmosphere. Companies buy them to offset emissions they can’t yet eliminate. The accounting questions are a minefield: Is it an asset? An expense? How do you value it? And crucially, how do you ensure it’s real and not just… hot air?

Untangling the Books: Accounting for Credits

The treatment varies, but the debate centers on intent. If you’re a speculator buying credits to resell, it’s an inventory asset. If you’re a company buying them to meet a compliance obligation, it’s more like a prepaid expense—you’re purchasing the right to emit. And if you generate credits (through reforestation or clean tech), that revenue needs recognition. The lack of universal standards here is a major pain point, creating comparability headaches for everyone.

| Scenario | Potential Accounting Treatment | The Core Challenge |

| Company purchases credits for compliance | Prepaid expense / intangible asset | Assuring the credit’s quality and permanence. |

| Developer generates & sells credits | Revenue upon verification & sale | Matching revenue with the costly development effort. |

| Trader holds credits for resale | Inventory held at fair value | Wild price volatility and illiquid markets. |

You see the issue? It’s a jungle. Accountants, alongside verifiers, are the ones building the guardrails—ensuring that a credit on a balance sheet actually represents a tonne of carbon that isn’t in the sky. Without their rigor, the entire market’s credibility crumbles.

The Human Element: Why This Isn’t Just Automation

Sure, a lot of this involves data and software. But this shift demands a new kind of accountant. One part detective, one part storyteller, and one part strategist. They have to understand climate science models, interpret evolving regulations, and then translate it all for the CFO and the investing public.

It requires professional skepticism—questioning the assumptions behind a carbon project’s claims. It requires judgment calls on valuation when markets are thin. In fact, it’s pushing the profession back towards its roots as a trusted, analytical advisor, not just a data processor. The “green accountant” is becoming a pivotal figure, sitting at the very intersection of profit and planet.

Looking Ahead: Integrated Thinking

The end goal? A world where financial statements don’t exist in a vacuum. Where the cost of carbon and the risk of a changing climate are baked into every P&L and balance sheet from the start. This is what they call integrated thinking. It means a company’s environmental footprint and its financial footprint are two sides of the same coin.

We’re not there yet. The standards are still settling. The carbon markets are finding their feet. But the direction is unmistakable. The role of accounting in climate risk and carbon trading is no longer a niche specialty. It’s becoming mainstream business literacy.

In the end, capital flows to where it understands the risk. By making climate risk tangible and carbon credits accountable, finance professionals aren’t just recording history anymore. They’re quietly, meticulously, helping to write a different future. One ledger entry at a time.